Substack is becoming part of the America Lexicon. From The New Yorker:

The Market 2025

My passion is the steady teaching of principles that are needed to attain wealth. I am passionate because these principles changed the course for myself, and my family’s lives and the lives of my clients. I didn’t make up new principles. I came to them over time as I learned what worked and what didn’t. I had a lot of good teachers. Warren Buffett, Peter Lynch and Nick Murray being the big three. There are no “breakthroughs” in stock market investing.

The latest Algorithm may or may not work. If it works a little it is copied, then quits working. We simply know that in time, stocks outperform all other paths to wealth creation and have built the vast majority of wealth in the US. Second of course is Real Estate. Shares of companies and real estate make up 99% of everything we refer to as “equity.”* Investing will always take faith, courage, knowledge and patience.

Over time, stock prices will follow the growth of earnings and dividends of a company. There are no other reasons. The rest is just psychology, noise and hype.

Nick Murray-my main line of thinking came from Nick Murray

Investment performance doesn't determine real-life returns; investor behavior does.

If you think the market’s 'too high' wait 'til you see it 20 years from now.

I can’t imagine what Nick Murray has added to the total net worth of Americans, but it may be unmatched.

I don’t try to guess where the market will be at a point in the short run. I rely on simple and undeniable rule. Get a pen, write this down on your forehead backwards, so you will see it when you look in the mirror. Quality equity assets appreciate in value over time. That is all we need to know. Now you just need to stay put and quit watching the financial news without supervision. If you do watch it, you get some good ideas but conflicting and some very bad advice mixed in. This causes anxiety and can lead to horrible consequences. I have done it, personally early on.

I have been in the market for 40 years. I have had the decades to go through many “disasters” in which my account was down by a large amount. And, because of that I have had the chance to buy stocks at ridiculously low prices. Any way you look at it, putting money into some good companies and forgetting about them for 2 or more decades, you will likely have a huge pile of money. But “this time is different! The 4 most costly words in stock investing.” It’s never different. Should I give just a few examples? I am not cherry picking. These are all well-known companies that make up the most traded companies year after year.

Stocks from 20 years ago until now. What if you put $10,000 into 2 or three of these in 2004? (stocks are adjusted for splits) The first number is the price of the stock 20 years ago. The second is the current price.

Costco Microsoft Apple McDonalds Netflix S&P

$41-$922 $28-$428 $1.20 -$245 $26-$296 $4.70-$882 $111-$595

Value of $10,00 invested in 2004

$226,000 $155,000 $2,000,000 $111,000 $1,870,000 $53,600

This time is not different.

What if you are old? You are lucky you didn’t die young! Add that to the following our philosophy is to live on the income from your portfolio. In other words, you won’t be forced to sell shares of stocks or funds to use for living expenses. That gives you freedom from worry as the markets inevitably go down regularly 20% or more (a bear market) about every 3.5 years on average. Then, if you pass away, your well-trained beneficiaries will receive the assets “in kind.” If they sell there is no tax. If they are smart, they will keep the stocks and take the income or let them grow.

Bear markets average a duration of about 9.6 months

Bear markets tend to be short-lived. The average length of a bear market is 289 days, or about 9.6 months. That's significantly shorter than the average length of a bull market, which is 965 days or 2.6 years. Bear markets come on average every 3.5 years. But there is no way to guess. Just stay put and let your companies do their thing. I started buying Apple stock about 2009. I invested $12,000. The value of the Apple I have now is $212,000. * And along the way I have donated shares to charities or sold to create liquidity to buy new investments. I know how to put you in good investments, but most anybody can do that if they have a computer and the right information. We don’t get paid to pick investments, we get paid to hold onto your ankles and keep you in the boat! That is, not to be second guessing yourself and to give you the faith and patience to not worry about the market in the short run.

Below are some thoughts about 2025 in general.

Politics

Most people are excited (59%) about getting past the last 4 years. We want a chance to not be manipulated by environmental zealots. We want to maintain the values and morals of our families and forefathers and add new ones slowly and cautiously.

People want to be free to speak their minds, not look over their shoulders worried you made the “wrong” comment or held the “wrong” opinion. We have been lied to again and again. So, we hope it will get better. I am hopeful. I think Trump will be good for markets overall. He has put together a cabinet that is extraordinarily capable. The left whines about the cabinet being white billionaires. Yes, DEI is almost dead, we can go back to choosing the best people and ignore putting people in groups. The use of racism to prevent racism should be on the ash heap of horrible ideas.

We all want a society where there is hope and plenty for all who want to work and take care of themselves and others. Most of us are exhausted by the list of victims made up by the elites who think they get to do that sort of thing. Telling a person or a large group of people they are “victims,” is poisonous to personal growth. We are sick of being called a “racist society” when the government, media and entertainment is fomenting racism while society has largely rejected it. But if we don’t notice racism, we are told we are so racist we can’t even see it. All to get votes by dividing people.

Many of us are sick of liberal do-gooders and virtue signalers who sit in their wealthy enclaves and think they know what is best for us. The electorate was not fooled by the doom and gloom stories of the press. We have seen through lies and manipulation.

Interest Rates

I don’t think interest rates will go down easily. Why? Because the economy is still doing well. If rates were 2-3% like they were on your old mortgage, the spending would be off the charts. The last 2 years we have been begging and fantasizing about rates going down. But the market did over 21% in 2023 and 2024 without lowering rates (much.) Maybe we should wish them to stay the same.

INTERMISSION-

The Wall Street Journal headline today: The Year That Hedge Funds Got Their Mojo Back

https://www.wsj.com/finance/investing/the-year-that-hedge-funds-got-their-mojo-back-9ad39209?mod=djem10point

Are Hedge funds worth the cost?

Warren Buffett famously bet a group of Hedge Fund managers. He bet that the S&P index would beat a group of handpicked hedge funds from 2007-2016. Of course, he won, and it wasn't close.

Hedge Funds standard charge 20% of the profits you make each year PLUS 2% of the amount that you have invested. This also means that your account here has creamed the hedge funds, and you pay 1% or less. Not sure why anyone buys them. It is my guess that the wealthy think they are more sophisticated owning hedge funds. (no one made less than the average Hedge Fund at 10.7%)

This breakthrough year, when the S&P was up 23% the average Hedge Fund was up 10.7% and they are bragging!

The AI boom is real

We didn’t know that 6-12 months ago. A lot of people said it was over-hyped and would burn out. It seems though that everyone wants it. All forms of business need it to compete. And we are just getting started. Some of these have run up a lot. The Magnificent 7 are Google, Microsoft, Tesla, Nvidia, Apple, Meta (Facebook) and Amazon. They were all way up for 2024. And they are all heavily dependent on AI to stay ahead. For now, AI tech is still key. It hasn’t peaked, not even close. We are talking about a technology that is theoretically infinite in its ability to expand.

Some of these stocks are overpriced or seem overpriced. But sometimes you want stocks that seem to always be “too expensive.” I thought for years that Microsoft and Costco, Chipotlte Mexican Grill, and many more and finally realized if I wanted in, I would have to pay up. I know you may have the “feeling” that you can get in and out of a stock and do better by timing the downturns. Don’t worry. It’s just a feeling!

Healthcare

Healthcare will generally be part of a long-term portfolio. 2024 was a bad year in general for healthcare stocks. Normally that is a sign to look at buying but I am not in a hurry. There is too much turmoil right now and for some of it, it is high time. Robert Kennedy Junior is scaring vaccine and drug makers. This could be good. We may make some headway on drugs and medical care, but that will be slow. We also have a shortage of doctors.

We seem to be getting better at preventative health. That should continue to reap savings at some point. However, we have our schools and government sabatoging the whole thing by promoting “body positivity” for the obese. They simultaneously promote healthy living while telling people overweight by hundreds of pounds that they are “OK” and to be proud. (See my blog: “Heart Attack Barbie”)

Why the Doctor shortage? Any clues?

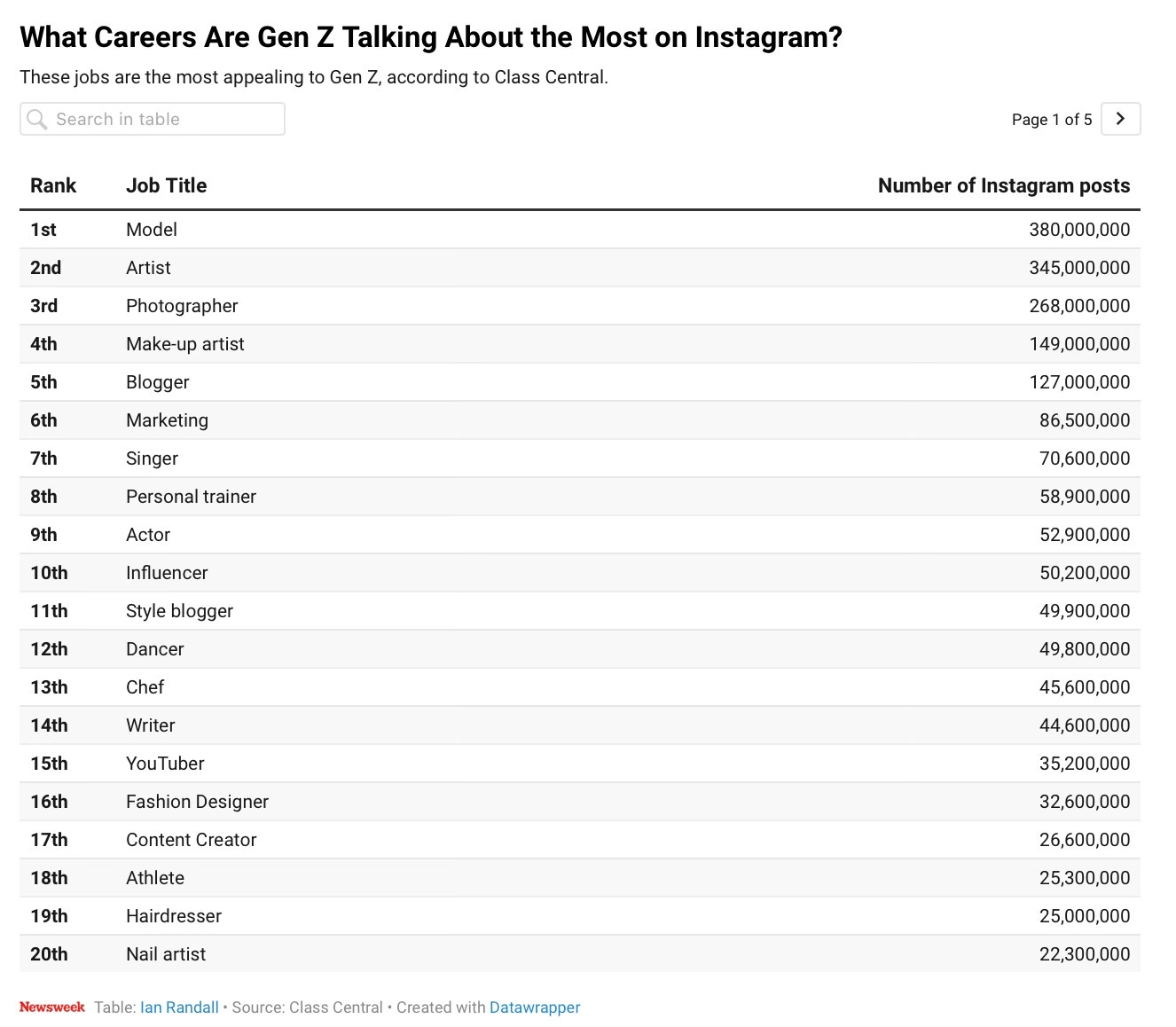

Here is one clue. This is the list of the top 20 professions Gen Z’ers are talking about on Instagram. Ranked by number of posts.

Not a doctor, teacher, lawyer, plumber or engineer in the bunch!

Life Expectancy

The US lost the advantage in expcted lifespan starting about 10 years ago:

US-79.1 years UK- 82 years Spain- 84 years Italy-84 years France- 83 years.

With a healthy, well run healthcare system we will have more predictable returns and healthcare will be a a good portion of our long term holdings. For almost all my career Healthcare has been a core holding. The 2024 return for the highly ranked Vanguard Healthcare fund was -1.59% compared to +23% for the S&P 500 index. We should lead the world. We don’t anymore. It can take over 6 months if you want an appointment for a specialist.

Covid the trust crusher. Public trust in physicians and hospitals plummeted, going from 71.5% in April 2020 to 40.1% in January 2024, according to a 50-state survey of U.S. adults led by Northeastern University's distinguished professor of political science and computer sciences.

You need to be your own advocate and really understand what risks your health may have. You only get 10-15 minutes with the doctor, and you may spend half of it reminding them who you are. I know there are some great doctors, and I have some. But in general, we have lost some faith.

Doctors have also shown us they can lose their minds just like anyone else. Cutting off healthy body parts of minors and calling it healthcare comes to mind. When the AMA (American Medical Association) and the APA (American Psychiatric Association) both endorse the idea that people can be “born in the wrong body,” we are in trouble. Are we in Medeivel times? In 10 or 20 years this will be looked apon as one of three national medical disgraces. The other two are lobotomies and Eugenics.

People are too chronically ill to fill the needs of military recruitment. The Pentagon “solves” this by just overlooking conditions that would have kept them out of service.

Pentagon expands list of medical conditions that no longer disqualify enlistment in armed forces

Read more at: https://www.stripes.com/theaters/us/2024-10-29/defense-department-enlistment-medical-conditions-15669730.html

Source - Stars and Stripes

Tanglec Web Funnies:

Next time- Energy, Nuclear Energy, Food and International stocks.

Thanks for Subscribing!

See you soon,

Craig